CT DRS CERT-112 2005-2024 free printable template

Show details

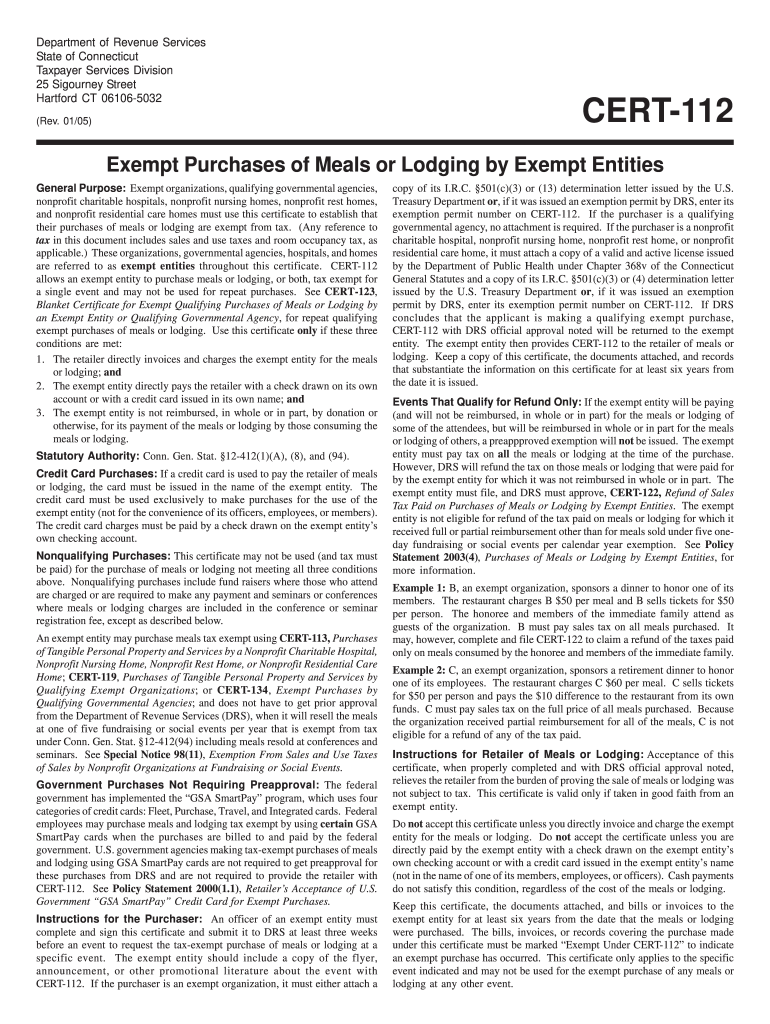

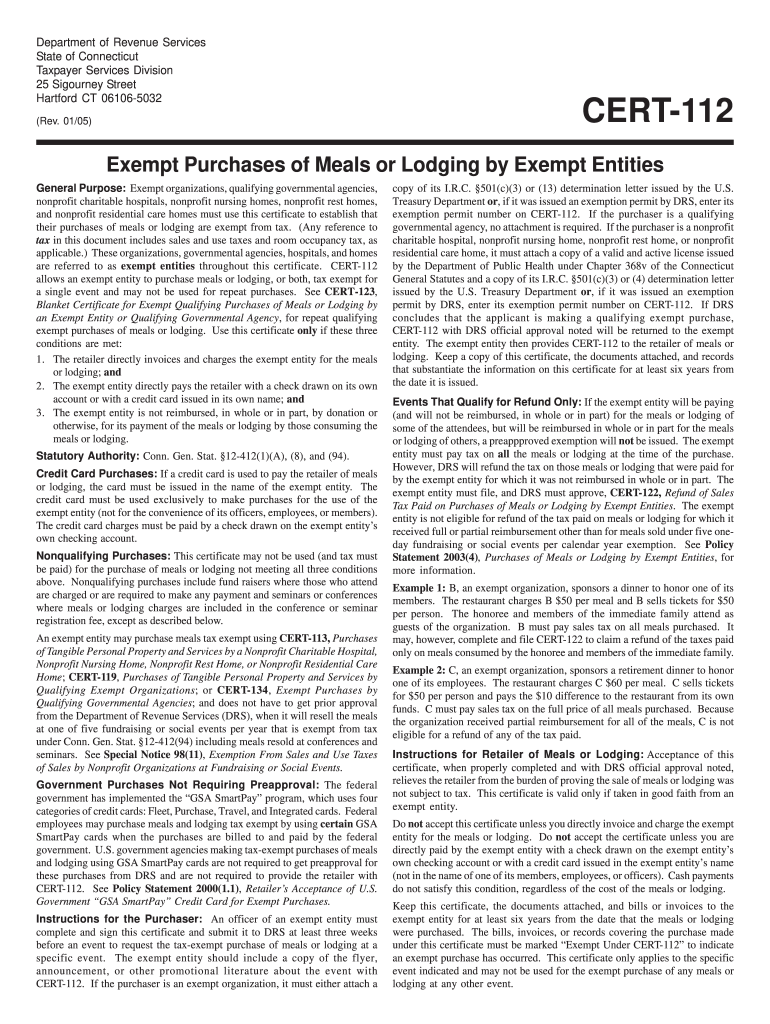

Department of Revenue Services State of Connecticut Taxpayer Services Division 25 Sigourney Street Hartford CT 06106-5032 (Rev. 01/05) CERT-112 Exempt Purchases of Meals or Lodging by Exempt Entities

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your cert 112 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cert 112 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cert 112 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ct 112 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out cert 112 form

How to fill out cert 112?

01

Begin by gathering all necessary information and documents required for completing cert 112.

02

Carefully read and understand the instructions provided on the cert 112 form.

03

Start filling out the form by entering your personal information accurately, such as full name, address, contact details, and any other required identification information.

04

Proceed to provide the necessary details about the purpose of cert 112, whether it is for employment, education, or any other specified reason.

05

Fill in any additional sections or fields on the form that are relevant to your specific situation or requirements.

06

Double-check all the information entered on cert 112 to ensure its accuracy and completeness.

07

Sign and date the form at the designated area to certify your understanding and agreement with the provided information.

08

Follow any final instructions provided on the cert 112 form, such as attaching supporting documents or submitting it to the appropriate authority.

Who needs cert 112?

01

Individuals who are applying for a job or seeking employment may need to fill out cert 112.

02

Educational institutions might require cert 112 for enrollment or admission purposes.

03

Immigration authorities or government agencies may also request cert 112 for verification or background checks.

04

Some organizations or employers might require cert 112 as part of their internal processes or to comply with certain legal requirements.

05

It is advisable to consult the specific institution or authority requesting cert 112 to determine the exact need and requirement for this form.

Fill form 112 : Try Risk Free

People Also Ask about cert 112

What is an St 12 in Massachusetts?

What is a sales tax exemption certificate in Massachusetts?

What is the tax exemption form for Massachusetts?

What is the exempt form for NYS sales tax?

Do Connecticut tax exempt certificates expire?

What is the exemption statute in CT?

What is exempt from sales tax in CT?

What is the tax exempt form for lodging in CT?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cert 112?

Cert 112 is not a recognized term or acronym in any specific field or industry. It is possible that it could be a reference to a specific certification program or standard in a particular domain, but without further information or context, it is difficult to provide a specific answer.

Who is required to file cert 112?

Form 112 is used by taxpayers who are claiming certain tax credits or refunds, such as the Foreign Tax Credit, Child Tax Credit, or General Business Credit.

In general, individuals and businesses who are eligible for these specific tax credits or refunds may be required to file Form 112. However, the specific eligibility requirements and filing obligations can vary depending on the specific tax credit or refund being claimed.

It is recommended to consult the IRS website or a tax professional to determine if you are required to file Form 112 based on your individual circumstances.

How to fill out cert 112?

To fill out Cert 112, follow these steps:

1. Obtain the Cert 112 form: You can typically find this form on the website of the relevant organization or agency that requires it. Alternatively, you may also request a copy from the organization directly.

2. Read the instructions: Review the instructions provided alongside the form to understand the purpose and requirements of each section.

3. Provide personal information: Fill in your personal details, such as your full name, address, contact information, and social security number. Ensure accuracy and legibility.

4. Indicate the certification type: Specify the type of certification you are applying for.

5. Include supporting documents: Attach any necessary supporting documents as requested by the form. This may include identification documents, educational transcripts, or other evidence relevant to the certification.

6. Complete applicable sections: Depending on the specific form, you may need to complete various sections. These might cover information about your qualifications, experience, references, and any fees payable.

7. Review and proofread: Before submitting the form, review it thoroughly for any errors or missing information. Double-check the spelling, grammar, and accuracy of all details provided.

8. Sign and date: Once you are satisfied with the information provided, sign and date the form in the designated spaces. Ensure your signature is legible.

9. Make copies: Make copies of the completed form and any supporting documents for your records before submitting it.

10. Submit the form: Follow the instructions provided on the form to submit it. This might involve mailing the form to the appropriate address or submitting it online through a designated portal.

Note that the specific steps and requirements may vary depending on the organization and purpose of the Cert 112 form. It's essential to carefully read and follow the instructions provided with the form to ensure accurate and complete submission.

What is the purpose of cert 112?

CERT 112 refers to the Cooperative Education and Related Training (CERT) Program Form 112, which is specific to educational institutions that offer cooperative education programs. The purpose of CERT 112 is to document and track the student's progress, attendance, and evaluation during their cooperative education experience.

The form provides detailed information about the student's work schedule, hours completed, the employer's evaluation of the student's job performance, and the student's self-evaluation. It serves as a way to assess the student's learning and growth during the cooperative education program and helps in determining their overall grade.

Overall, the purpose of CERT 112 is to ensure that students in cooperative education programs are meeting the requirements of their education institution and are gaining valuable work experience related to their field of study.

What information must be reported on cert 112?

CERT-112, also known as the "Combined Excise Tax Return and Fuel Tax Schedule," is a tax form that is used to report and pay various excise taxes. The specific information that must be reported on CERT-112 may vary depending on the state or jurisdiction, as different tax laws and regulations apply. However, in most cases, the following information is typically required on CERT-112:

1. Business Information: This includes the name, address, and identification number (such as employer identification number or social security number) of the business filing the return.

2. Reporting Period: CERT-112 is generally filed on a monthly, quarterly, or annual basis. The reporting period for which the return is being filed must be specified.

3. Gross Receipts: The total amount of revenue received by the business during the reporting period is reported here.

4. Taxable Sales: This refers to the portion of gross receipts that are subject to excise tax. It involves identifying and reporting the different types of taxable sales, such as retail sales, rentals, leases, or specific industries that have separate excise tax regulations.

5. Excise Tax Due: The amount of excise tax that is owed by the business for the reporting period should be calculated and reported here. Excise taxes can vary significantly depending on the goods or services being sold, so the specific tax rates and calculations applicable to each category should be considered.

6. Fuel Tax Schedule: If the business is involved in the sale or use of fuels, a separate schedule is often included with CERT-112 to report fuel-related information. This may include the number of gallons sold, the type of fuel sold, the tax rate applicable to each type, and any exemptions or refunds claimed.

7. Credits and Deductions: Any applicable credits or deductions that may reduce the amount of excise tax owed can be reported in this section.

8. Amount Due/Overpayment: After calculating the total excise tax due and applying any credits or deductions, the final amount owed to the tax authority or any overpayment to be refunded should be indicated.

It is important to note that the specific requirements and instructions for completing CERT-112 may vary by jurisdiction, so businesses should carefully review the official form and instructions provided by the respective tax authority.

How can I manage my cert 112 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ct 112 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make edits in exempt entity issued search without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your drs from exemption, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit exempt entity cert search on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute cert exempt entities search form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your cert 112 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exempt Entity Issued Search is not the form you're looking for?Search for another form here.

Keywords relevant to taxpayer ct meals form

Related to drs cert

If you believe that this page should be taken down, please follow our DMCA take down process

here

.