CT DRS CERT-123 2024-2025 free printable template

Show details

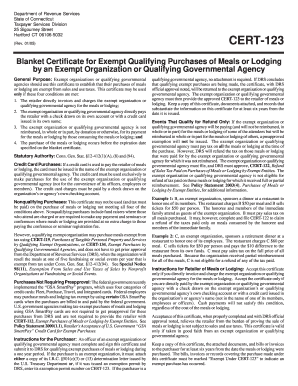

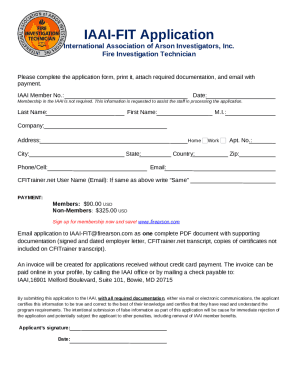

Processing times for a CERT 123 approval is 30 days from the time the document is received. What does the purchaser do with the certificate after they re approved CERT-123 to the retailer of the meals or lodging. Department of Revenue Services State of Connecticut 450 Columbus Blvd Ste 1 Hartford CT 06103-1837 CERT-123 Rev* 12/24 Blanket Certificate for Exempt Qualifying Purchases of Meals or Lodging by Exempt Entities This certificate must be approved by the Department of Revenue Services...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cert 112 form

Edit your cert123 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CERT-123 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CERT-123 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT DRS CERT-123. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CERT-123 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CERT-123

How to fill out CT DRS CERT-123

01

Obtain the CT DRS CERT-123 form from the Connecticut Department of Revenue Services website or office.

02

Read the instructions carefully before filling out the form.

03

Fill in the identifying information at the top of the form, including your name, address, and contact information.

04

Provide the necessary details about the tax year for which you are filing the form.

05

Complete any required sections based on your specific tax situation and the type of tax you are reporting.

06

Double-check all entered information for accuracy before submitting.

07

Sign and date the form at the designated area to certify the information provided.

08

Submit the completed form according to the provided submission instructions, either by mailing it to the appropriate address or submitting it online if available.

Who needs CT DRS CERT-123?

01

Individuals or businesses required to report certain tax information to the Connecticut Department of Revenue Services.

02

Taxpayers who are claiming specific exemptions or credits that necessitate the use of the CERT-123 form.

03

Accountants or tax professionals assisting clients with Connecticut tax filings.

Fill

form

: Try Risk Free

People Also Ask about

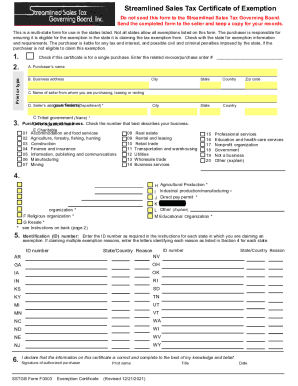

What is exempt from sales tax in CT?

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

What is the number for CT tax exempt?

You may contact the IRS Tax Exempt and Government Entities Division for further information at 877-829-5500.

What is the tax exempt form for lodging in CT?

CERT-112 allows an exempt entity to purchase meals or lodging, or both, tax exempt for a single event and may not be used for repeat purchases.

What is my CT registration number?

Connecticut Tax Registration Number Locate your twelve-digit ( ) registration number on any previously filed state tax return (Form CT-941) or correspondence from CT Department of Revenue Services.

How do I get a Connecticut tax registration number?

Go to myconneCT, under Business Registration, click New Business/Need a CT Registration Number? There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

What is the registration tax in Connecticut?

Private sale. Passenger vehicles and light duty trucks purchased from private owners (not a dealership) are subject to sales tax of 6.35% (or 7.75% for vehicles over $50,000).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT DRS CERT-123 for eSignature?

When you're ready to share your CT DRS CERT-123, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit CT DRS CERT-123 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your CT DRS CERT-123, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the CT DRS CERT-123 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your CT DRS CERT-123.

What is CT DRS CERT-123?

CT DRS CERT-123 is a certificate used by entities in Connecticut to claim exemption from certain taxes, specifically for purchases made in connection with manufacturing, research and development, or other qualified activities.

Who is required to file CT DRS CERT-123?

Entities engaged in activities that qualify for tax exemptions under Connecticut state law, such as manufacturers and certain research organizations, are required to file CT DRS CERT-123.

How to fill out CT DRS CERT-123?

To fill out CT DRS CERT-123, entities must provide their name, address, type of exemption being claimed, details about the transaction, and any relevant supporting documentation as required by the form.

What is the purpose of CT DRS CERT-123?

The purpose of CT DRS CERT-123 is to provide a formal mechanism for eligible entities to claim exemptions from sales and use taxes, and to ensure compliance with state tax regulations.

What information must be reported on CT DRS CERT-123?

Information that must be reported on CT DRS CERT-123 includes the entity's name and address, the nature of the exemption being claimed, detailed descriptions of the items or services purchased, and the date of the transaction.

Fill out your CT DRS CERT-123 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CERT-123 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.